So you’ve discovered mortgage note investing, and now you want to buy notes online.

First, congratulations, because note investing is one of the most attractive investments in the market today.

Before you start looking for notes to buy online, understand that if you find notes through a marketplace, a hedge fund, or any other kind of broker or reseller, you’re paying retail.

Paying Retail vs. Wholesale

Now paying retail does have some benefits. You won’t have to spend the time you normally would in finding the notes or prospecting sellers. The drawback, of course, is that you’re going to be paying full price. If a note is listed for sale online somewhere, rest assured that any of the opportunistic returns have already been squeezed from the asset.

Alternatively, if you find notes from direct sellers with a tool like BankProspector, then you can expect that you’re buying off-market notes at a discount, probably a deep discount.

Most of the places to buy notes online on this list will offer you retail pricing. If you’re just getting started and don’t have the stomach, the time, or the ability to find your own notes, but you do have your own cash, these investment platforms and note-sellers can be a great place to start.

If you’re a bit more industrious and you don’t mind doing the work to make more money, then you should investigate BankProspector, the only service on this list built to help you find the seller-direct discounted and distressed off-market notes.

BankProspector

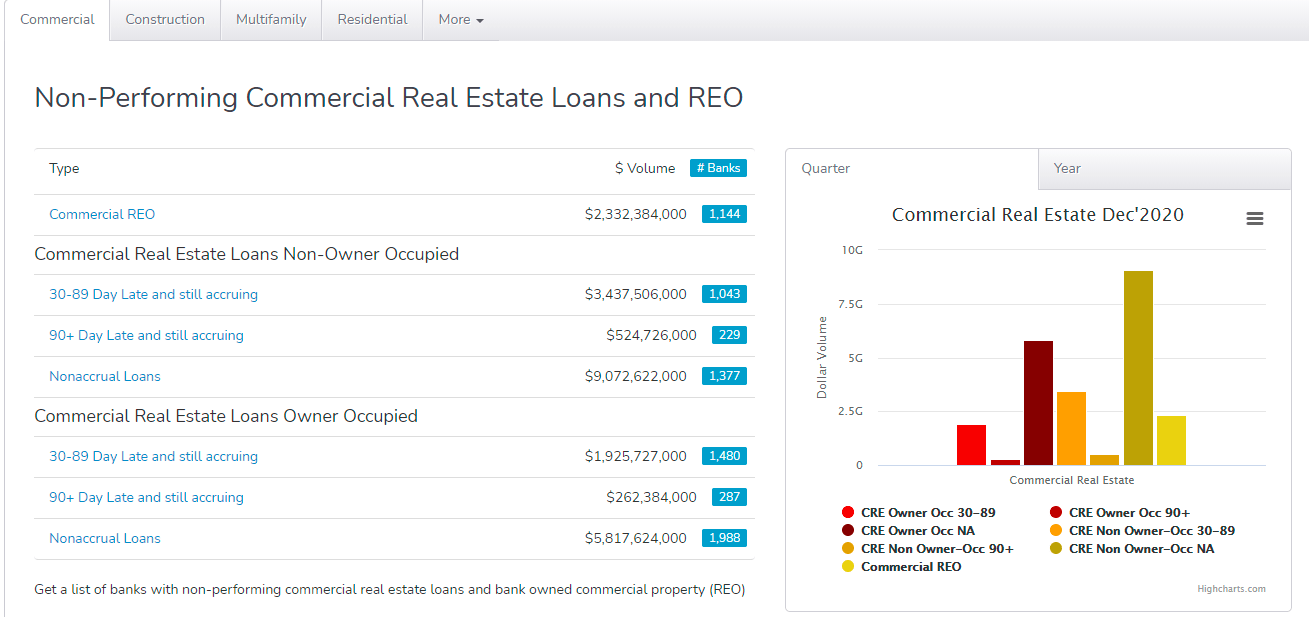

BankProspector is a software tool used by note investors and brokers, real estate investors, house flippers, REO agents, commercial note brokers, and others to find lender-direct non-performing note and REO deals. The platform provides bank data, decision-maker contact info, and “sell” indicators that help note buyers target banks and credit unions to get the best deals on off-market notes and REO.

Features:

- Eliminate the middlemen, “hedge funds,†and online joker-brokers.

- See any bank or credit unions non-performing and performing note portfolio info and “sell” indicators.

- Get key contacts and decision makers with name, phone and email.

- Stop chasing desperate “one-off†private sellers with no equity.

Paperstac

Paperstac is a platform that allows you to list and bid on mortgage notes for free. They only charge a 1% service fee when you close a deal. This way, you only pay after you successfully buy a mortgage note. Paperstac also features a dashboard that guides you through the entire process of buying a mortgage note online.

Paperstac provides users with access to their proven sales method, which helps if it’s your first time buying a note online or if you prefer to follow a more streamlined process. They also offer a checklist so you can make sure that you do everything in the correct order and account for all the little things that are essential for a successful purchase.

Features:

- Timeline View consolidates all of your communications, making data and insights easy to read and digest.

- Electronic Notary function coordinates your electronic signatures and facilitates any online notary services that you might need

- Telecom Specialist creates a new number for each transaction

- Step-by-step guide through their proven process for buying notes online

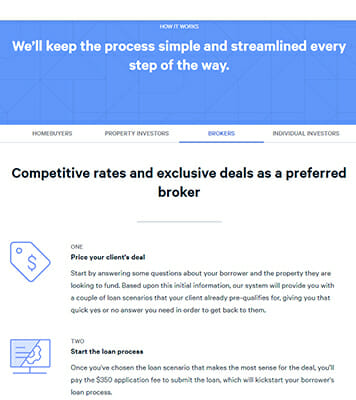

Fund That Flip

Fund That Flip is an easy-to-use lending and investment network that connects property buyers with investor-funded loans. From application to closing, the funding process is web-based and user-friendly, and investors have access to real-time opportunities and insights. Most loans are hard-money or fix-and-flip, and all are pre-vetted by FTF experts.

Features:

- Most loans are lower risk, coming in at or below 65% LTV/ARV.

- Up to 9.25% annual yield

- Invest as little as $5,000

- FTF team sources and underwrites projects, delivering high-quality, typically low-risk investment-ready notes

FCI Exchange {currently offline}

FCI Exchange is the largest and most well-known platform for note buyers and sellers. They have a long track record in the industry and provide a lot of information on the various notes before you have to put in a formal offer. This is great for market research and finding out what comparable notes are selling for in your target area.

Features:

- No membership or registration fees

- 1% Listing Fee

- Special Due Services

- Lots of information about the notes for sale without having to sign up

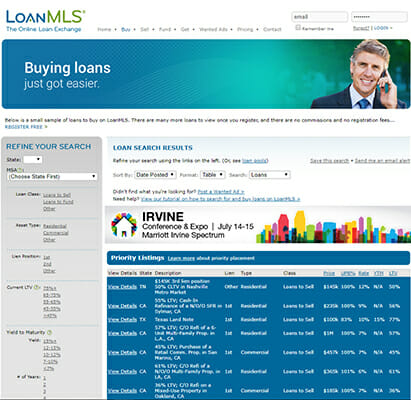

LoanMLS

Loan MLS is an online loan exchange with over 20,000 qualified mortgage note buyers and sellers using their network to find deals every day. They have a wanted ads section that allows you to specify the type of notes you are looking for, so you can be very specific about the deals that you’re seeking.

Features:

- Fund new loan originators or invest with a note broker

- Use the wanted ads to get specific note offers

- No fees or commissions to buy a real estate note

- Lots of links to hard money lenders in all 50 states

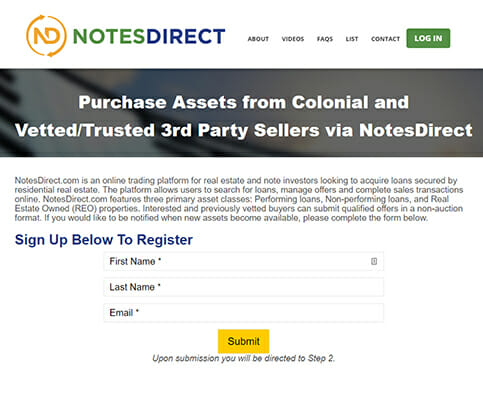

Notes Direct

Notes Direct is a great place to buy real estate notes and REO. They have a few beneficial videos on the homepage that will show you how to use the website and search for assets after registering to use their marketplace. They have a great selection of non-performing, REO, and performing notes.

Features:

- Great how-to videos on the homepage

- Free sign up and account registration

- $750 flat fee per asset closing

- Manage offers and complete sales within your personal dashboard

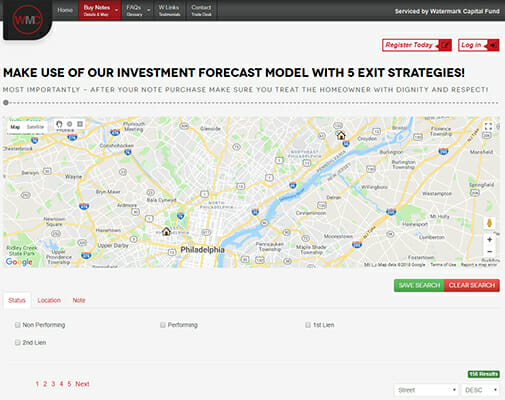

Watermark Exchange

Watermark Exchange offers a unique trading platform that is focused on geographical areas. They target offers for prospective buyers with a map of all the properties in a selected region. They work with large institutional sellers and local banks to provide them with a steady flow of competitively priced real estate notes.

Features:

- Unique map of properties in your target area

- In-house due diligence platform

- Investment forecast model for every deal

- Special access to off-market assets in their buyer’s club

Peer Street

Peer Street helps accredited investors find private real estate-backed loans. Peer Street works with the best originators all over the country to provide you with high-quality, diverse sets of real estate-backed loans. You can create your own portfolio, or you could let them do it for you through their Automated Investing.

Features:

- 6-9% annualized returns

- Simple done-for-you way to invest in real estate notes online

- Invest as little as $1,000 per loan

- Hands off, automated investing option

Lending Home

Lending Home allows investors to buy mortgage notes with Lending Home as the originator. They handpick mortgage loans for you according to the options you have chosen when you sign up. Once they verify your accredited investor status, you will get access to your custom offers.

Features:

- 5-10% annualized returns

- Choose your risk profile and diversify your account however you like

- Monthly interest payments

- Up to date performance dashboard to help you manage your investments

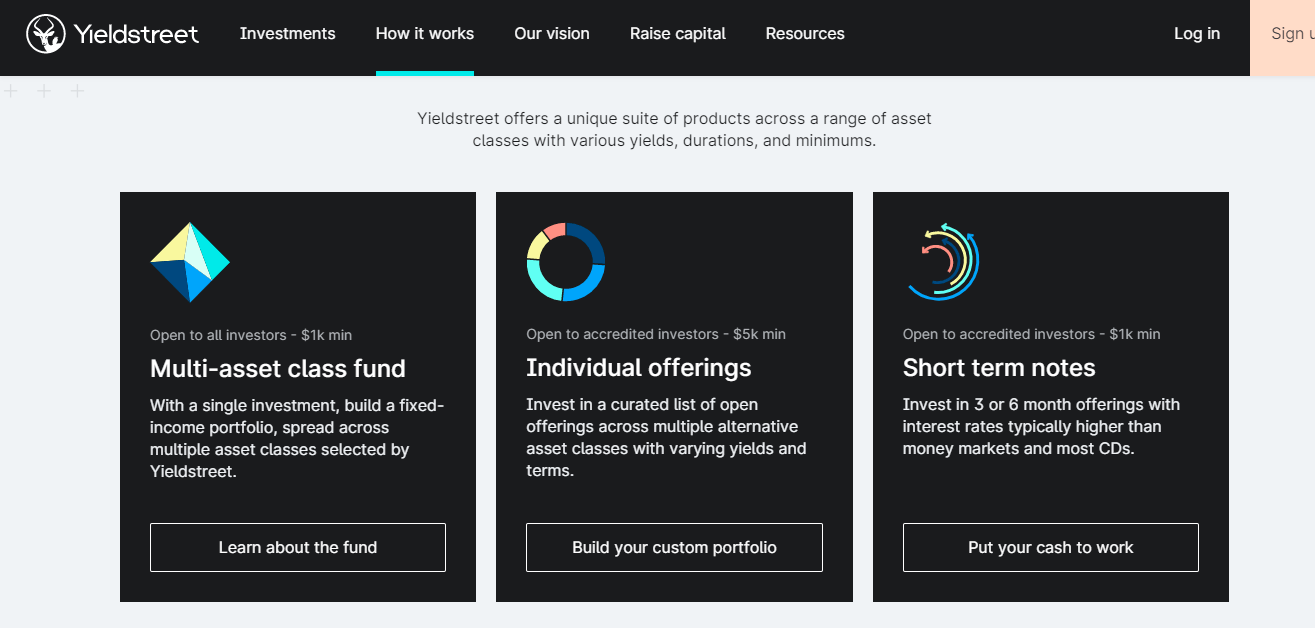

Yieldstreet

Yieldstreet is a diverse crowdfunding investment platform that offers unique, often otherwise-inaccessible investment opportunities in asset classes ranging from notes and commercial real estate to art and supply chain financing. Some Yieldstreet assets are reserved for accredited investors, though its Prism fund is open to all.

Features:

- Minimum investments start at $5,000-$10,000

- Asset-backed investments

- Easy-to-use website with detailed listings

- Allows investors access to private structured financing deals

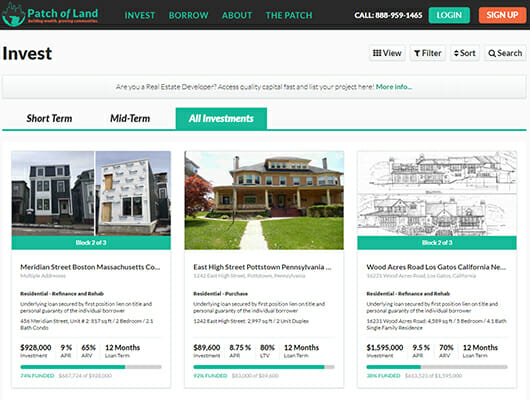

Patch of Land

Patch of Land is a crowdfunding website that specializes in raising funding for real estate projects. As an investor, you will be able to invest in promising real estate projects along with other experienced investors. Patch of Land handles the deal sourcing and all of the due diligence before publishing the projects online. They even put some of their own money into the projects that they promote.

Features:

- Earn up to 12% APR with only a minimum $5,000 investment per loan

- Short-term notes ranging from 30 days to 36 months

- Digitally sign and complete on loans through their platform

- Regular property updates and project milestones sent directly to your dashboard

Fundrise

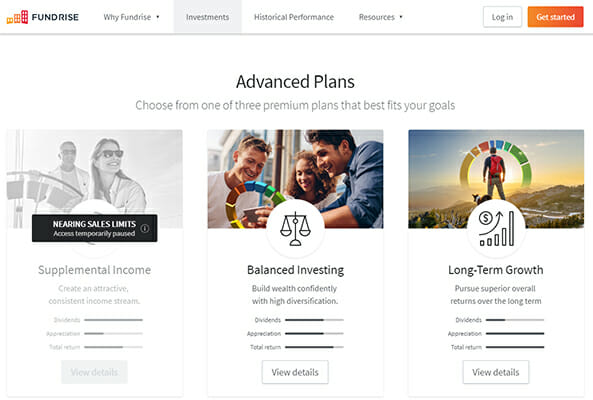

Fundrise allows you to invest alongside a team of very well-experienced real estate investors on the projects they have personally researched and vetted. Simply choose the real estate portfolio you are interested in, and they will acquire and manage the properties for you. You don’t have to worry about all the hassle of closing the sale or dealing with tenants. Best of all, your investment is backed by real assets. Fundrise is an easy way to invest in real estate notes.

Features:

- $500 starter account with a 90-day satisfaction period

- Choose the perfect investment plan to suit your lifestyle

- Easily diversify your portfolio without the hassle of active management

- All of their offerings are regulated by the Securities and Exchange Commission (SEC)

Note Investing Case Study

Do I Need a License to Broker Notes?

4 Step System for Buying Distressed Assets Direct from Banks

The Definitive Guide To Distressed Property

I like this article very much. Can you compile a list of top paying note buyers as well?

I’m not sure how we’d get “top paying” but we do have a database of note buyers which we call the Verified Investor’s Database. Verifiable investors can sign up here to be listed.

Hi Brecht,

I just came across this article when you shared it on LinkedIn. So, my question to you is how am I going to compete with these large companies who obviously have large advertising budgets, reputations, probably cash reserves and investors. Then there’s the auction sites….Ten-X, Auction.com and Tranzon. What do I have to do to make it in this obviously competitive business?

Thanks!