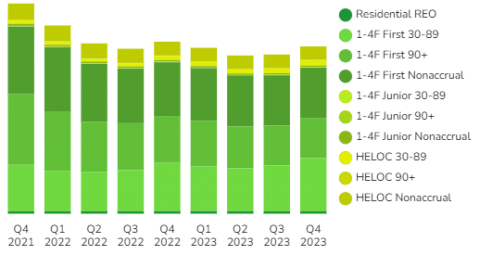

The residential mortgage loan sector seems to be following its typical seasonal pattern, with another uptick in non-performing loans in Q4.

An additional $2.5 billion in newly late residential loans were reported at the end of the year, along with a slight increase in 90+ day late loans.

Let’s dive into the latest bank data from Q4 to see exactly what is going on.

Banks Hold Over $47B First Position Non-Performing Residential Mortgages

Banks saw an increase of more than $3B more in non-performing first position residential loans in the last three months of the year.

US banks reported over $17B in first mortgages on 1-4 family properties which are in the 30-89 day late stage, up by around $2.5B from the previous quarter, and up around $7.5B from Q1. This suggests that more homeowners may be plummeting into financial distress…even before their year-end shopping sprees show up on their credit card statements.

Already ahead of those are around $16.5B first position non accrual loans on 1-4 family residences, as well as over $13B in 90 day plus late loans, which have not been classified as non accrual yet.

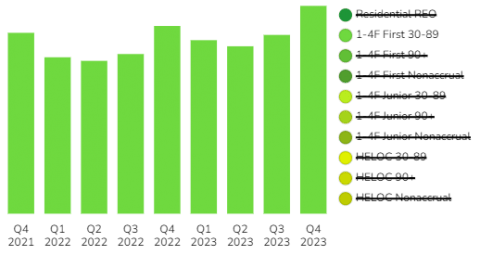

Residential REOs

678 banks reported that they held residential REO at the end of Q4 2023, up slightly from Q3, and almost double than in Q1.

At $752M, this is still a very small percentage of the total volume of distressed residential loans being held by banks right now.

This could easily accelerate this year as households finally run out of credit and savings while grappling with ongoing extreme inflation and a further deteriorating job market.

Non-Performing Residential Loans

The largest percentage non-performing residential mortgage loans is now in the newly late category.

As of Q4 the breakdown of non-performing first mortgage liens being reported includes:

- $17.5B in 30-89 day late loans

- $13.1B in 90 day plus late and still accruing loans

- $16.5B in non-accrual loans

Discover the 3,000 plus banks holding these non-performing loans inside BankProspector now.

Junior Liens

At the end of Q4 2023 there were over $4.4B in nonaccrual stage revolving lines of credit. Additionally, there were around $1.65B in newly delinquent HELOCs behind those as well as close to $200M in 90+ day late credit lines.

Defaults on revolving credit lines (HELOCs) continue to be higher than on fixed second mortgages.

Dive into the BankProspector dashboard to find out which banks are reporting the most distressed residential junior lien loans and HELOCS.

Looking Ahead

Bank data from the fourth quarter shows the residential loan market in about the same shape as as the previous two quarters. Yet, with a fresh surge in newly delinquent loans.

Landlords and homeowners face ongoing financial challenges impacting their ability to pay; most notably, inflation and unemployment.

The opportunities are growing for investors as increases in residential loans enter the non-performing pipeline.

Log in now to see which banks are currently holding the most distressed loans…