Comerica Bank

Locations

Comerica Bank REO

Comerica Bank's REO and Non-Performing Loan Report

Comerica Bank's REO Report

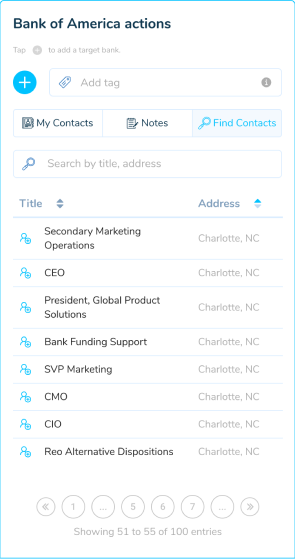

Comerica Bank's bank owned homes total $0 0% from the previous quarter. Comerica Bank foreclosures include $0 commercial REO, $0 multifamily REO, $0 farmland and agricultrual REO, and $0 in construction loan REOs. To get a Comerica Bank foreclosures list you must contact an REO asset manager at the REO department. Use the button on the right to find workout officers, asset managers, and other contacts at Comerica Bank BankProspector helps you easily find the special assets and REO department contacts or any other Comerica Bank decision maker.

Comerica Bank Portfolio Info

Subscribers have access to the portfolio info for Comerica Bank and any other Banks in Texas.

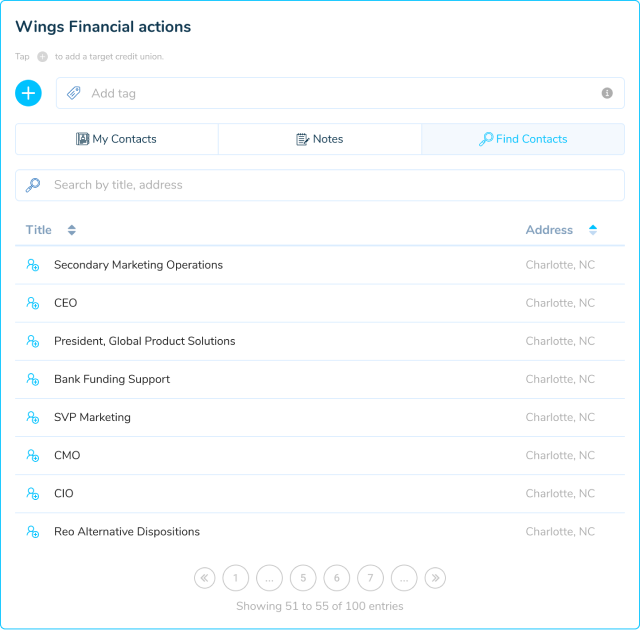

Our members use BankProspector to find and qualify banks and bank contacts with distressed assets. BankProspector is the fastest easiest way to source your own bank direct deals. Find the Asset Managers at Comerica Bank as Well as Other Bank Contacts Subscribers use BankProspector to find contacts including executives and officers in departments like special assets or workout departments.

Comerica Bank FDIC Call Report

All of the portfolio and financial information in our reports is pulled directly from FDIC. We take updates from the federal reporting database for all US banks.

Comerica Bank's Late and Non-Performing Loan Portfolios

Residential 1st Position Loans

Residential Junior Position Loans

HELOCs

Commercial Real Estate Loans

(Non Owner-Occupied)

Commercial Real Estate Loans (Owner-Occupied)

Multifamily and Apartment Loans

Residential Construction Loans

Commercial and Development Construction Loans

Farmland Loans

Business Loans (C&I)

Non Performing Auto Loans

Comerica Bank Foreclosures and Non-Performing Loans

What can we help you find?

Here’s an example of our data

We track and report all the foreclosure, REO (bank owned property) non-performing note, and decision maker information for every bank and credit union in the United States and U.S. Territories.

Since 2009 we've been tracking REO, non-performing loans, and contact information for every other bank and credit union in the US. Join our free private list and we'll show you how you can start doing more bank direct deals.